This ongoing review process ensures that a business stays on track to meet its financial objectives and that managers can make informed decisions about resource allocation and revise budgets as and when necessary. Managerial accounting delves into how various factors—such as changes in production processes, pricing strategies, or overall market conditions—affect a business’s cost, revenue, and profitability. The biggest benefit is that businesses can implement targeted improvements once they know the root cause of unexpected outcomes. Compliance with accounting regulations also helps to ensure that financial information is accurate and reliable, providing stakeholders with the information they need to make informed decisions. Certified Public Accountants (CPAs) are often employed in public accounting firms and are responsible for auditing financial statements to ensure their accuracy.

What is the difference between managerial accounting and financial reporting?

For instance, investors might look at a company’s balance sheet to understand whether it can meet its debt obligations. Examples of management accounting include preparing budgets, analyzing costs, and creating performance reports. Both financial accounting and management accounting are concerned with the financial information of an organization.

Adhering to Compliance Requirements

- This post explains the difference between financial accounting and management accounting in detail.

- While both managerial and financial accounting sometimes use the same data, managerial accounting has a broader scope that is more relevant for internal use.

- Break-even point analysis is useful for determining price points for products and services.

- This can be done by creating a robust integration system that uses financial data not just for compliance and reporting but also for strategic decision-making.

You may also need to monitor bank statements, investments, and more, requiring similar steps to preparing financial statements for a business. Managerial accounting focuses on operational reporting and looks to the future by using forecasting. These reports are shared internally within the company, typically with managers and senior employees. Accountants prepare these documents and send them directly to personnel within a company, such as managers and executives. These reports break down numbers and projections related to departments, products, employees and customers and how they affect the company.

GAAP and Accounting Standards

These internal users may include management at all levels in all departments, owners, and other employees. For example, in the budget development process, a company such as Tesla may want to project the costs of producing a new line of automobiles. Although outside parties might be interested in this information, companies like Tesla, Microsoft, and Boeing spend significant amounts of time and money to keep their proprietary information secret. Companies value both fields and may require accountants to have specialized knowledge in the area or a certain certification. The certified public accountant designation — CPA for short — is the gold standard for accountants who want to practice financial accounting. The certified management accountant designation, or CMA, is a designation that focuses more specifically on the cost management, performance management and decision analysis that managerial accountants practice.

Financial Accounting vs. Managerial Accounting: Differences

For example, managers in the production department may want to see their financial information displayed as a percentage of units produced in the period. The HR department manager may be interested in seeing a graph of salaries by employee over a period of time. Managerial accounting is able to meet the needs of both departments by offering information in whatever format is most beneficial to that specific need. Financial accounting does have certain applications within an organization, but its primary goal is to provide information to others who are not affiliated with that organization. The final accounts or financial statements created via the process of financial accounting are intended to reflect the business performance of the company as well as its current and future financial health. Scaling a startup without proper financial oversight can easily lead to cash flow problems, operational efficiency issues, and, in the worst cases, significant financial losses.

Standards

Whether they are managerial accountants or financial accountants, they spend much of their time keeping the books. They are responsible for accurately recording every transaction that a company makes, whether it’s paying a contractor or buying a new machine. For those who want to better understand their organization’s financial performance in the context of the markets and contribute to financial strategy, exploring the fundamentals of finance can be beneficial.

Managerial accounting is not concerned with the value of these items, only their productivity. Management accounting is primarily concerned with the managers of a company and the provision of useful information intended for internal use. These principles are subject to ever-changing rules and regulations, as well as disputed interpretations. You work tirelessly for two straight days compiling projections of sales and revenues to prepare the reports. Investopedia is considered to be the largest Internet financial education resource in the world. There are many short, helpful videos that explain various concepts of managerial accounting.

This helps develop responsiveness to such changes rather than sticking to a specific plan that may not even work in a dynamic environment. Managerial accounting analyzes quantitative and qualitative data so that all aspects of your business are considered when planning for the future. For instance, it can help estimate the financial effects of launching a new product line and set realistic goals that best align with your resources and efforts. Consistency in financial record management is critical because it lays the foundation for decision-making in an organization. Managerial accountants achieve this by creating detailed budgets, tracking actual spending against these budgets, and analyzing any differences.

Since it mainly addresses internal financial matters, managerial accounting doesn’t need to follow any external standards. This data-driven approach helps a business focus its resources on the most profitable areas and decide whether to invest or cut back. In this way, managerial accounting helps ensure that a business stays competitive and financially sound.

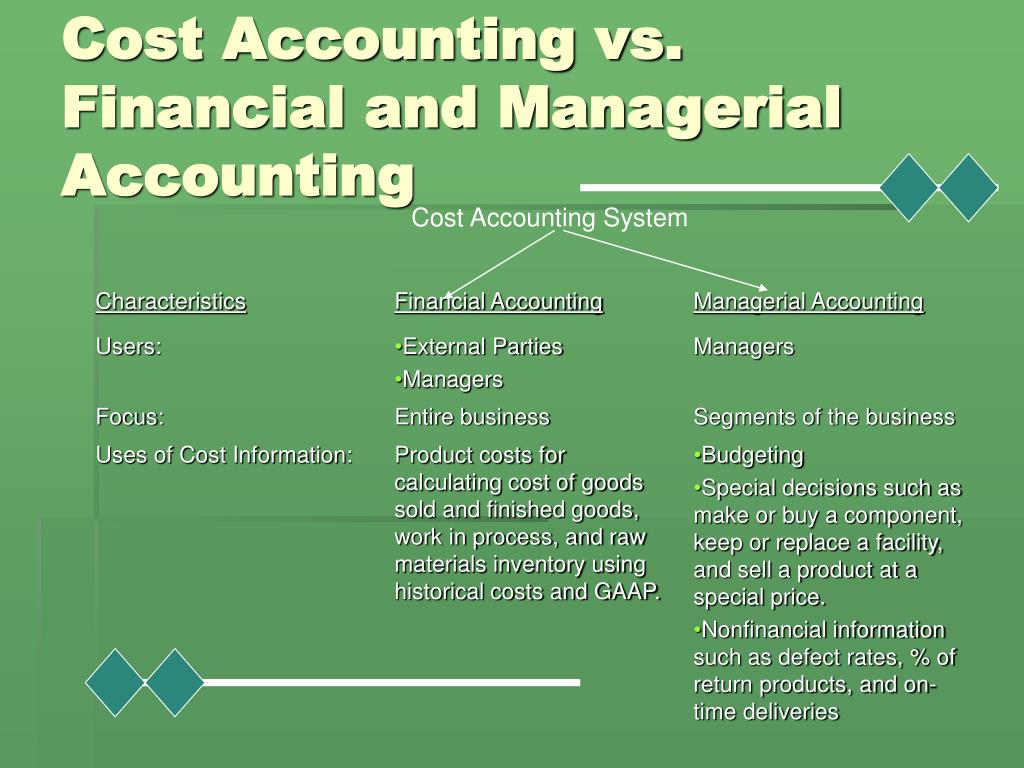

Financial and Management Accounting deal with different aspects of the business operations and so both systems are distinct from each other. The purpose of financial accounting is to provide information about past events, while that of managerial accounting is to help decision-makers within their organizations plan better for the future. Furthermore, both are concerned with revenue, expenses, assets, liabilities, and flows of cash. Because financial accounting typically focuses on the company as a whole, external users of this loans and grants information choose to invest or loan money to the entire company, not to a department or division within the company. Financial accounting focuses on the overall value of a company’s assets and liabilities, whereas managerial accounting analyzes the assets and liabilities to understand a company’s profit and productivity. A financial accounting system is aimed at external decision-makers such as investors, regulators, and creditors, while a managerial accounting system is aimed at internal decision-makers such as managers.