Its particularly important understand should your loan application is approved otherwise disapproved if you have currently produced a down payment so you’re able to an excellent possessions designer or you don’t want to reduce a trending assets. Inquire just how quick he or she is when you look at the handling the application. Specific financial institutions make sure as little as five days to convey a decision. Usually, it will require weekly. Be wary out-of timely handling states which can actually grab months instead of days, says Bobby.

What you need is to try to have time to utilize having a unique lender in case your app becomes disapproved. To take the fresh new safe, Alex claims one essentially, you really need to apply for the loan very first and safer acceptance regarding the lending company just before expenses any cash because the no one can to be certain you regarding the length of time it takes a bank so you can techniques your loan or if perhaps it can actually become approved after all. Particular banking companies take more time than usual so you’re able to agree that loan since the particular issues with the fresh label of your own guarantee assets.

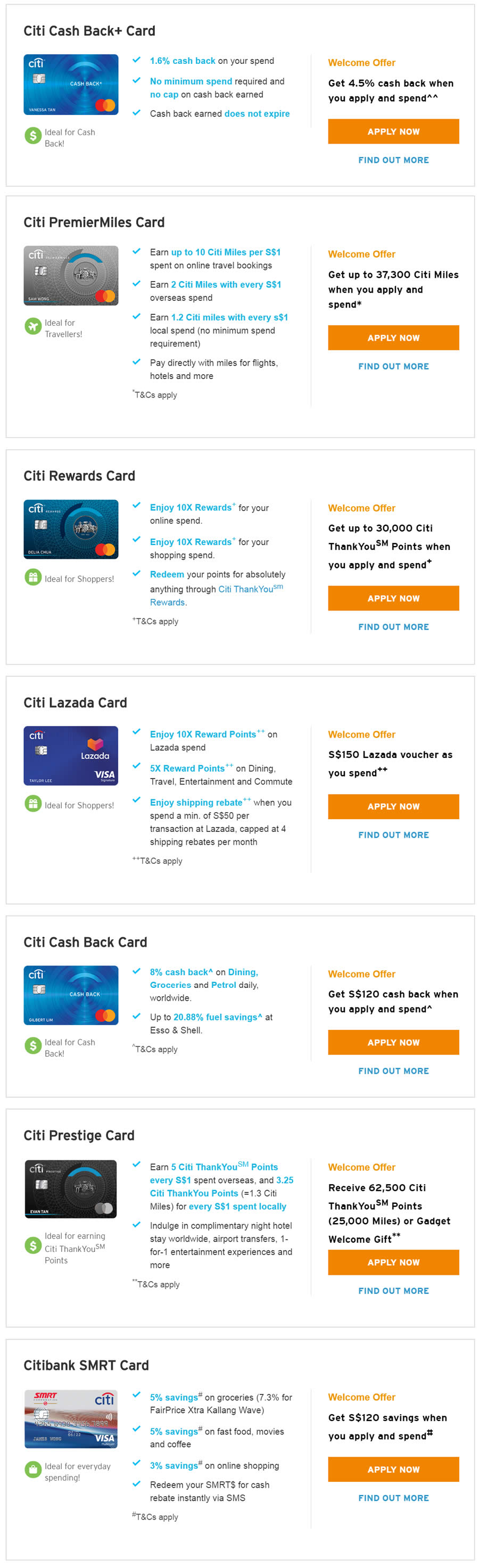

Someone else provide discounts otherwise bucks backs just like the a finite promo

In addition need to make sure it is easy and easier getting you to definitely spend the amortization. Continue reading « As well as the guarantee is applicable on condition that all your files were published to the new bank’s pleasure »