- Comments

Financial prices skyrocket to 23-12 months highest

Dave Ramsey and you can a screen regarding financial specialists join ‘FOX & Friends’ to fairly share advice for Us citizens trying to purchase property and approaches for holiday think.

Since ages-highest mortgage rates shake-up the real house land, financial specialists on Ramsey Selection team keeps provided advice about homeowners so you can navigate brand new erratic business.

« While of financial obligation and you have your own disaster funds, rates commonly going to go anywhere however, upwards, despite rates of interest rising, » Ramsey Options inventor Dave Ramsey told you toward a good « Fox & Friends » committee Monday. « So if you get mortgage that you do not eg, your obviously can be re-finance later and now have straight back from it. Nevertheless the housing industry merely stalled. »

« And man, i got Soft Weekend with the college loans throwing back in Sunday, and you can Christmas was influence down on us, » the guy went on, « and so it is the right time to log in to a spending plan and you can get on an idea. »

The typical speed to your benchmark 31-year financial reached its large top because year 2000, expanding loans Echo Hills from eight.19% a week ago so you can 7.31% this week, with respect to the current studies by Freddie Mac.

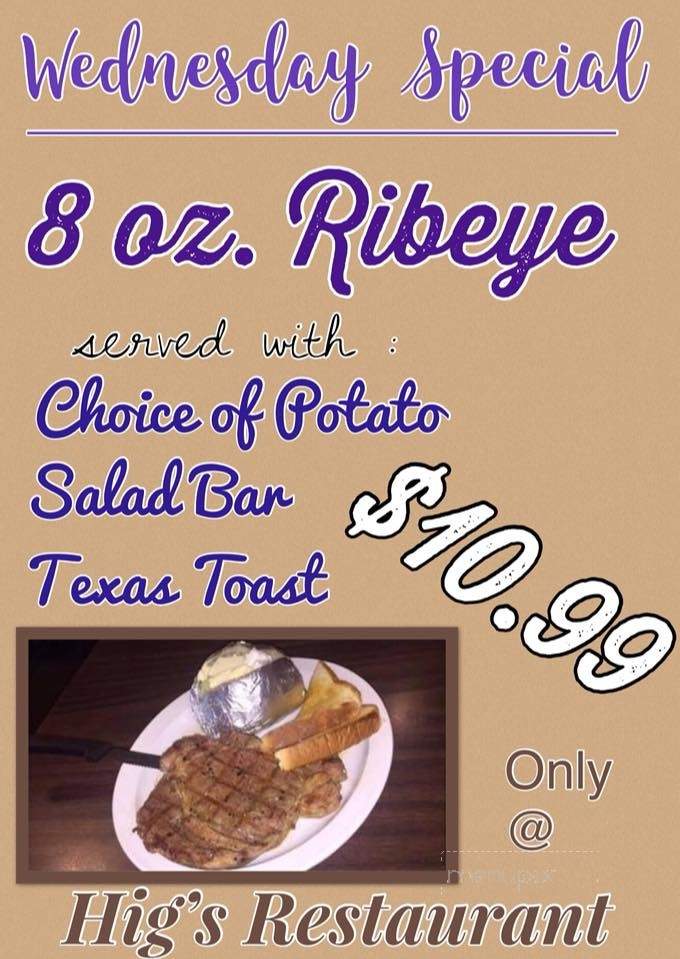

A monetary pro panel with Ramsey Choice personalities spotlighted the significance away from budgeting on « Fox & Friends » Tuesday amid ages-high mortgage cost and you can festive season purchasing. (Fox Development)

« Whenever you are a millennial, you are Gen Z, you’re hopeless now. You feel cynical, » « The brand new Ramsey Tell you » co-host George Kamel along with told you Saturday. « Thus i must let them have particular hope that it is you are able to to them, nevertheless got to store the new FOMO because your parents are saying, ‘You’re throwing away cash on rent, get a home, score a property, score a property,’ and you’re bankrupt. »

Continue reading « ‘It’s for you personally to log on to a resources,’ Dave Ramsey states »