The retained earnings account is reduced by the amount paid out in dividends through a debit and the dividends expense is credited. Income summary is a holding account used to aggregate all income accounts except for dividend expenses. It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process.

Closing Entry Definition, Types & Examples

Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts. Temporary account balances can be shifted directly to the retained earnings account or an intermediate account known as the income summary account. Closing all temporary accounts to the income summary account leaves an audit trail for accountants to follow.

What is an income summary account?

Although the drawings account is not an income statement account, it is still classified as a temporary account and needs a closing journal entry to zero the balance for the next accounting period. Closing entries are performed after adjusting entries in the accounting cycle. Adjusting entries ensures that revenues and expenses are appropriately recognized in the correct accounting period. Once adjusting entries have been made, closing entries are used to reset temporary accounts. Closing entries are journal entries made at the end of an accounting period, that transfer temporary account balances into a permanent account. Now that all the temporary accounts are closed, the income summary account should have a balance equal to the net income shown on Paul’s income statement.

Everything to Run Your Business

Remember that all revenue, sales, income, and gain accounts are closed in this entry. Lastly, you’ll repeat the process for each temporary account that you have to close. Alright, with a high-level understanding let’s dive into the 4-step close process. They are special entries posted at the end of an accounting period. Using the above steps, let’s go through an example of what the closing entry process may look like. We’ll use a company called MacroAuto that creates and installs specialized exhaust systems for race cars.

Post navigation

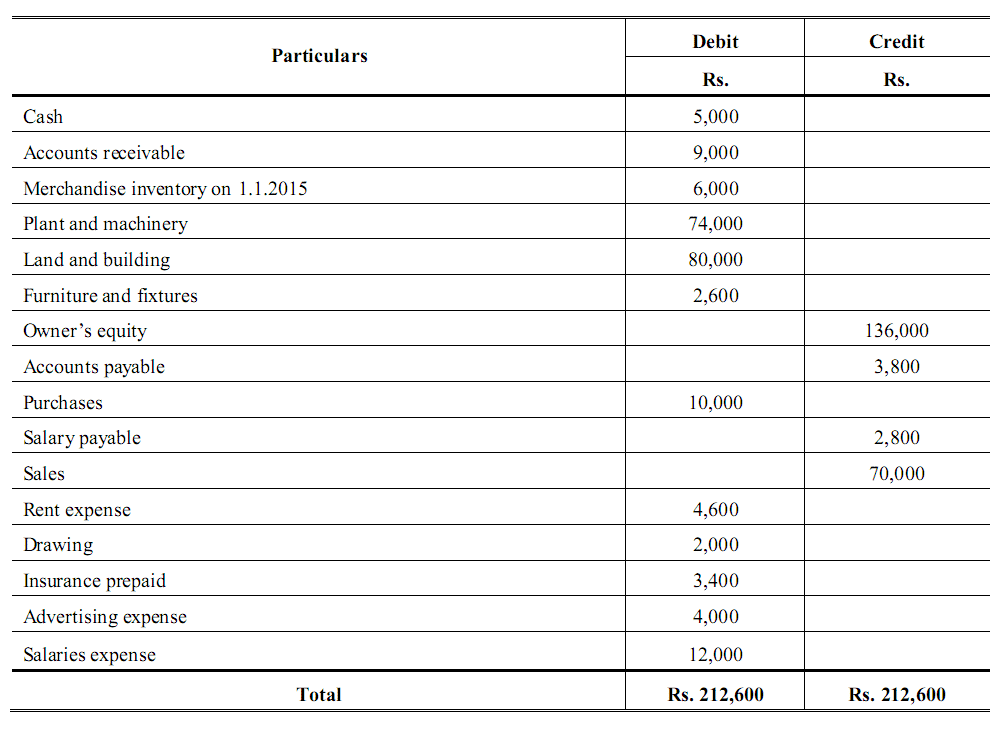

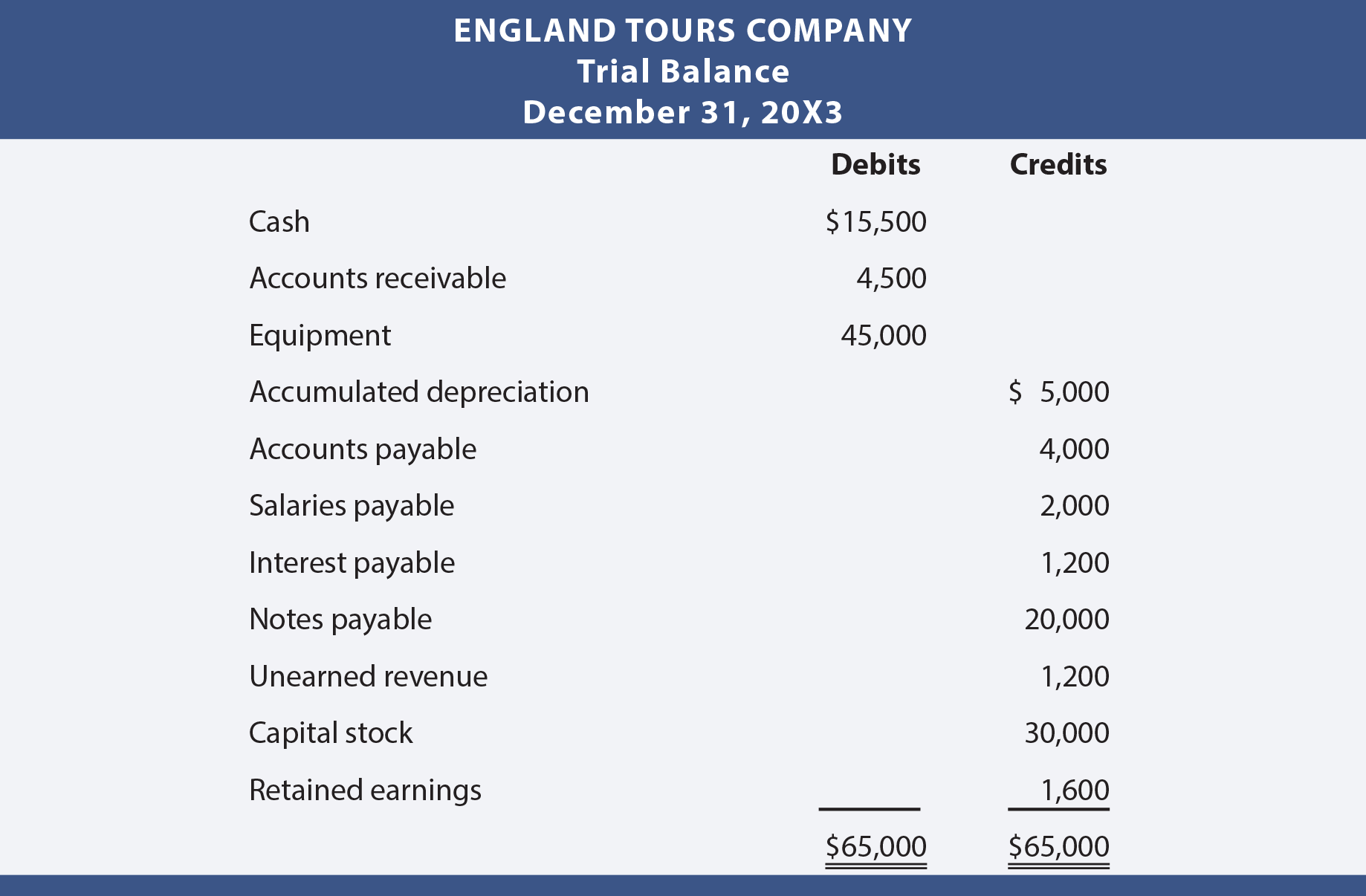

As we mentioned, these include revenue, expense, and dividend accounts. From this trial balance, as we learned in the prior section, you make your financial statements. After the financial statements are finalized and you are 100 percent sure that all the adjustments are posted and everything is in balance, you create and post the closing entries. The closing entries are the last journal entries that get posted to the ledger. After the posting of this closing entry, the income summary now has a credit balance of $14,750 ($70,400 credit posted minus the $55,650 debit posted).

- Retained earnings represent the amount your business owns after paying expenses and dividends for a specific time period.

- Temporary accounts are used to accumulate income statement activity during a reporting period.

- To do this, their balances are emptied into the income summary account.

- At the start of the new accounting period, the closing balance from the previous accounting period is brought forward and becomes the new opening balance on the account.

- Thus, the income summary temporarily holds only revenue and expense balances.

Closing Entry in Accounting: Definition, Example, and Best Practices

All temporary accounts eventually get closed to retained earnings and are presented on the balance sheet. Closing all temporary accounts to the retained earnings account is faster than using the income summary account method because it saves a step. There is no need to close temporary accounts to another temporary account (income summary account) in order to then close that again. ‘Total expenses‘ account is credited to record the closing entry for expense accounts. Closing entries transfer the balances from the temporary accounts to a permanent or real account at the end of the accounting year. We see from the adjusted trial balance that our revenue account has a credit balance.

We can also see that the debit equals credit; hence, it adheres to the accounting principle of double-entry accounting. After this closing entry has been posted, each of these revenue accounts has a zero balance, whereas the Income Summary has a credit balance of $7,400. After preparing the closing entries excel accounting and bookkeeping above, Service Revenue will now be zero. The expense accounts and withdrawal account will now also be zero. At the end of a financial period, businesses will go through the process of detailing their revenue and expenses. The closing journal entries example comprises of opening and closing balances.

The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period. The income summary is used to transfer the balances of temporary accounts to retained earnings, which is a permanent account on the balance sheet.