An excellent recast mortgage is a choice for homeowners who are in need of to help you tweak their mortgage repayments. Really huge finance companies create a minumum of one recast for a person having a conventional (Fannie mae otherwise Freddie Mac) mortgage.

So you’re able to recast the borrowed funds, the master tends to make a swelling-contribution percentage on the financing dominating. Minimal number that has to be made is the lender’s name. The financial institution after that items another type of amortization plan, now that have down payments. Decreasing the loans leftover to your financing dominant form there is certainly today reduced appeal to expend.

In short, an element of the idea having a loan recast try remaining a similar mortgage conditions – especially important to the people whose loans curently have low interest, and people who need to prevent resetting the term from many years – however, lightening the fresh payment per month owed from here on the. A great recast shall be a fascinating choice having a citizen who had need to decrease the prominent in one dropped swoop, leaving the size of the loan since it is, just with all the way down upcoming repayments.

Exactly what are the Main Benefits and drawbacks off a mortgage loan Recast?

The huge benefits are derived from the trouble. Including, a citizen may have a large amount of bucks within an excellent given time. Possibly the homeowner passed on currency, offered a home, or obtained a big bonus. When this occurs, that loan recast is one answer to adopt a disciplined using trend. By allocating a substantial amount of money to your family loans now, the particular owner provides alleviated the newest month-to-month home loan personal debt responsibility after. That do better satisfaction.

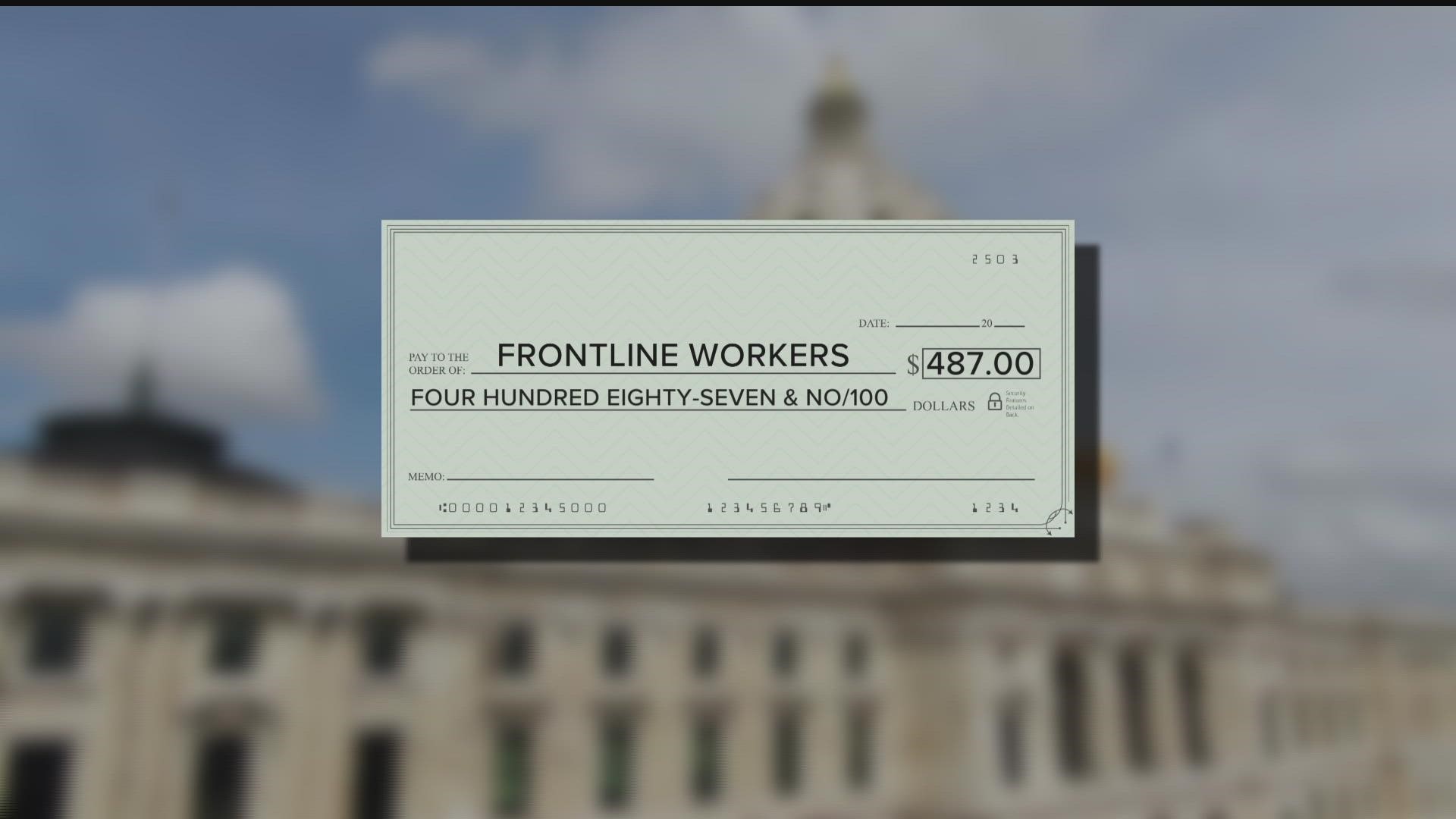

Of course, you will find charges to cover the fresh recast control, but not as much as with lots of other financing points. When you have an enormous sum of money to place into your house security, then you are extremely unlikely to help you sweat a couple of hundred cash, at most, in costs.

- Can be your latest interest reasonable, and they are you delighted remaining it? Financing recast can help you exercise.

- Do you repay the higher-focus personal credit card debt first? Approaching new pull from higher-attract personal debt are going to be a good homeowner’s financial consideration.

- After paying new lump sum payment with the mortgage, do you possess sufficient money on submit a family savings should you want to buy? Even if recasting a home loan try a simple and you can efficient way in order to lighten the weight of obligations, are you presently sure we want to tie-up such currency in your home?

If you have imagine through the implications and choose so you can recast, you are injecting money in to your house. Value, after placed into the house, will get unavailable to other uses, or for other opportunities. Therefore, specific manage argue that recasting a loan was a complete waste of a great obligations.

As to why Recast, rather than Re-finance?

The latest recast is a somewhat easy processes, compared to refinancing. Furthermore a less expensive, faster intrusive processes than simply refinancing. But as to the reasons just do a citizen propose to recast a home loan?

A deeper need to consider a mortgage loan recast requires the preferred disease in which a resident don’t get approved having good refinanced financial currently, on account of a credit history matter or something like that else. New recast might help the citizen afford the financial down reduced from the recasting the principal and continuing and also make costs towards plan up until mortgage recognition will get you are able to.

Maybe the proprietor try looking to functions less occasions each week, and requirements a quickly in check monthly payment obligation on age in the future. Most likely the homeowner has already been experiencing the current month-to-month mortgage payment while the huge drag toward income. If the a monthly mortgage payment is too onerous and also the citizen can also be inject a large sum now to carry overall monthly houses will set you back below twenty-eight% from normal month-to-month income, since credit bureaus recommend, up coming recasting may be a great circulate. These situations introduce sensible reasons why you should pay alot more today while having a lighter stream later on – to not transform all other terms of the mortgage.