We understand the newest fulfillment off giving probably the littlest of gifts can also be quick a smile out-of anybody you adore. And you will we’d all of the choose to let our house participants on the big-ticket activities, such delivering a base towards houses hierarchy.

Most of us envision we cannot manage to assist financially up to just after our own death. But exactly how much nicer being be there whenever assistance is most required: to blow tuition, donate to a wedding, otherwise greatest within the crisis funds when money is rigorous. A good way of life genetics can mean providing children or grandchildren a step up within beginning of the their travels, and collateral launch is one way away from gifting money to help you loved ones when they want to buy really.

But exactly how ample do you become with respect to gifting money to family relations? How does inheriting property which have guarantee launch affect heredity income tax? We are going to protection these types of concerns on this page, and help you probably know how gifting currency so you’re able to family unit members and you may inheritance taxation really works.

How come inheritance tax apply at gifting money to help you family relations?

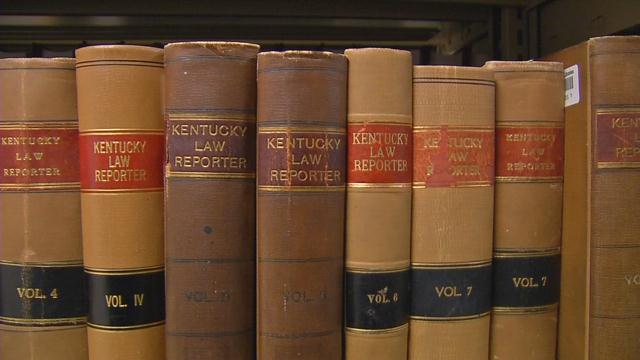

Inheritance tax can seem to be difficult. It is paid to the overall worth of your house, that’s computed by the addition of upwards all of your assets (just like your home, and you will people savings or opportunities you have got) and you will taking off one money or debts you borrowed. Guarantee launch influences inheritance tax because it’s as part of the matter you borrowed. Your heirs would have to spend 40% of anything more a set allotment, and that at the moment stands at the ?325,000 (for ), and up to ?175,000 to have property which had been your primary quarters.

Gifting money so you can relatives before you could pass away will potentially treat the worth of your house. Whether your full property value the fresh new house may be worth lower than ?2 million in addition to possessions might have been remaining in order to an infant otherwise grandchild, this may bring it lower than those all the-essential allocation thresholds. The new hook is that you need certainly to real time having eight ages after and then make high gift ideas for the money not to ever be added as part of your home. Its common to send money given that gift suggestions so you can family members to enjoy life’s goals regardless of if we shall speak about how much cash you could potentially current 2nd.

The amount of money would you gift so you’re able installment loans online Washington to friends tax-free?

Its good to learn you can make some money gift suggestions to help you members of the family as opposed to thinking about everything span! Every year you could present up to all in all, ?step three,000, separated right up in fashion; and doing ?250 to as many individuals as you wish when they have not received any part of the ?3,000 yearly gift allotment. For individuals who haven’t used it upwards, you can carry-over the ?step three,000 allocation for 1 taxation year, your ?250 allowance can not be sent more than.

You can even current up to ?5,000 to an infant who is getting married otherwise starting an excellent municipal commitment, ?dos,five-hundred if it’s a grandchild otherwise great-grandchild or ?step one,000 to the other person. Once again, these presents wouldn’t number to have heredity income tax.

Whenever you are impact really good-sized, you could blend your own gifting allowance. Therefore if a baby was tying the knot, you can current all of them ?5,000 together with your ?step 3,000 annual different in identical tax seasons. And in case wedding preparation requires longer than requested, and rolls for the next taxation season, and you also haven’t talented this ?step 3,000 to someone else, your financial allowance lso are-set and you can current a little more.

Please remember, you could physically hand out doing you like and you may if you reside having eight decades, it will not count within your home. If you perish inside 7 many years throughout the big date of the gift next certain otherwise all the really worth will be included on the value of the house while the recipient ount.

How-to present currency so you can loved ones with collateral launch

For most people, the house is the greatest part of our home. Additionally, it is a fundamental element of the emotional better-being; few of us appreciate the notion of moving, such as for example as we grow older. But swinging and you can downsizing was previously recognized as the only real solution to launch some of the worth locked up during the bricks and you can mortar for individuals who planned to violation it for the before you pass away.

Now, you should use a lifetime financial, a kind of guarantee release designed for more 55s (or over 50 for the Fee Name Lifetime Home loan). You do not spend taxation to your equity discharge, and it is are a familiar way of helping aside for the 2023, one out of 10 your Life Home loan people made use of the currency to present to help you a family member. Prior to gifting currency to friends, it is critical to contemplate how collateral discharge and you will genetics taxation often connect with all of them after later on regardless of if.