There are many reasons to refinance that loan: You can also switch to a lesser rate of interest, reduce your monthly obligations, otherwise mark extra financing. For highest funds, for example lenders, refinancing can save a fortune in the long run. This is especially valid for many who very own cellular homes, plus don’t has actually mortgage loans but instead possess chattel finance.

A beneficial chattel mortgage funds a cellular home since a bit of personal possessions rather than since the home. Consequently, the interest prices during these financing are much higher than simply what a mortgage carry out demand. Which higher rate renders the master which have a huge monthly payment and you can a hefty level of appeal along the longevity of its loan.

A good way that mobile homeowners can be lower this type of will set you back is through refinancing. From the switching your own chattel loan on the an interest rate you might conserve a king’s ransom along side long term.

Trick Takeaways

- Many mobile land are financed by the a chattel financing as opposed to a mortgage, and you may chattel fund features higher interest levels.

- Mobile homes you to satisfy certain standards might possibly convert on real estate and thus feel qualified to receive a home loan.

- Two of the main hurdles of getting a mortgage toward good mobile home try a bona fide property title and you may a permanent base.

- If you’re able to follow the measures needed seriously to convert the mortgage to help you a mortgage, you could conserve much when you look at the interest and you will monthly payments.

Refinancing a cellular Family

Refinancing your current cellular home chattel financing to the a mortgage loan takes some work, however it is worth it into the will set you back you can save. For starters, you might secure dramatically reduced interest rates for the remainder of the mortgage title. Most chattel money provides pricing of 7% to up to a dozen%. For most off 2020, cost towards the 31-12 months repaired mortgage loans was significantly less than 3.5%, which development is a lot a comparable into the 2021.

How to get home financing

Still, due to the fact appealing as the a mortgage may sound, getting a cellular the home of be eligible for such financing there are numerous even more difficulties. Although perfect conditions can differ a bit by lender and by county, new mobile household would need to meet certain style of the latest following:

- It ought to be intent on a permanent, fixed foundation.

- It cannot keeps rims, axles, or a beneficial pulling hitch.

- It will was indeed established just after June fifteen, 1976.

- It should have a foundation that meets the brand new Company off Property and Urban Development’s standards.

- It will have a real house term, perhaps not your own possessions label.

There are some ways to get doing such regulations, and that we’re going to go into eventually. Normally, the largest challenge with refinancing a mobile financial is dependant on transforming new house’s latest personal property label to your a bona-fide estate identity.

Tips Convert to a bona fide Estate Term

In certain states, discover an obvious-slash techniques based on how to transform a personal property title towards a bona fide home name. Usually you can find really detail by detail rules for what home are and is also perhaps not. In other claims, it could be harder.

Because bringing a concept are an elaborate judge process, you may register a genuine estate attorneys getting let. You can consult a neighbor hood name providers knowing the fresh new perfect steps.

After you focus on the newest name providers to transform brand new identity, you may then begin doing your research having mortgages. You need to run loan providers whom give money on the cellular land. Not all the lenders bring this type of finance.

What direction to go if you don’t Qualify

Though it is much easier discover a bona fide house term (and you will a mortgage loan for that matter) for those who own new site there house your mobile home is wear, you’ll find exceptions. For many who lease their lot into the a mobile home society or from some sort of a property manager, then you might nevertheless meet the requirements within the Federal Property Administration’s Term step one system. Getting entitled to a concept step one financial, you ought to:

An attached basis can cost as little as $step three,500 or as much as $12,000 or even more. The seller things, although final price depends mainly into the footprint of the household.

The Government Houses Management keeps very rigorous conditions to have mobile domestic loads, sites, or groups, so be sure to favor a (as well as your landlord) that have caution when you are considering providing a subject step one mortgage loan.

There are various will cost you that include refinancing your cellular family which have a mortgage. Most are individuals who have one home loan process, however may also must set aside a little extra currency to afford a lot more rules to have cellular residential property.

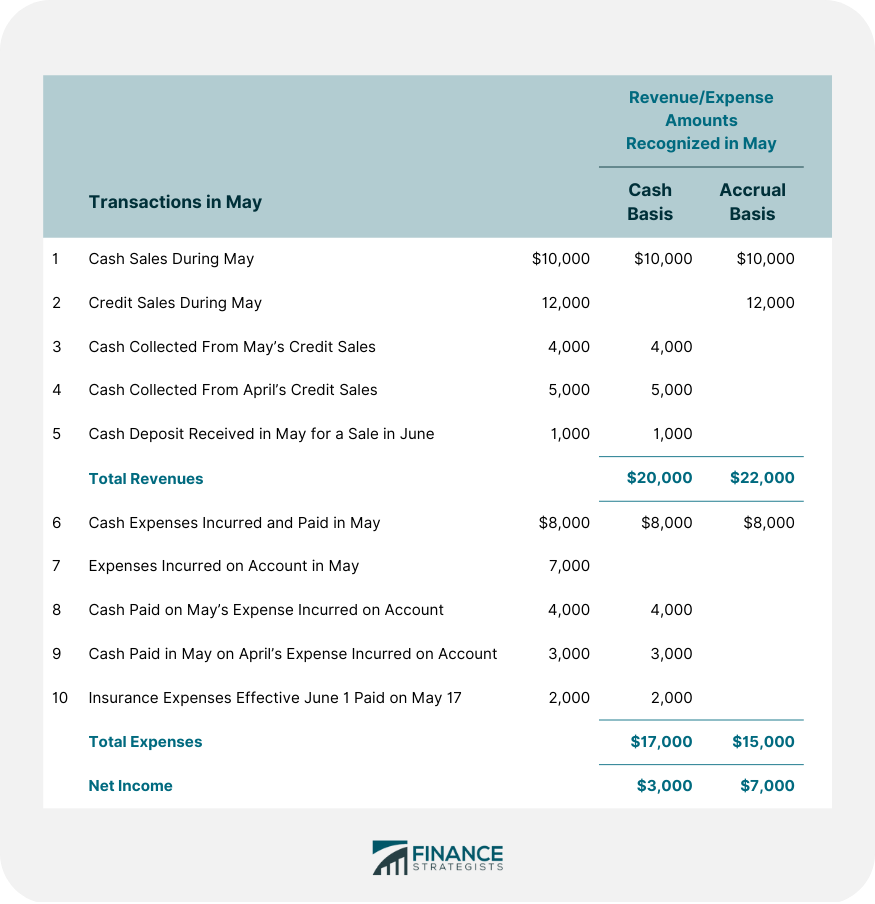

Very first, understand the consequences on the taxes. Chattel fees and you can real estate taxation differ, so you might owe more (otherwise faster) when you transfer their identity.

There will even be can cost you in order to processes and you will over their mortgage financing. Given that when buying a fundamental home, you’ll want to cover an advance payment, lender charges, closing costs, so there are almost every other fees, also. This type of is dependent upon your own financial or representative, and the charge it charges for every financing.

If you rented assist at any stage (such as toward term, or an agent to analyze tons, or perhaps to see web site), so it price of work can also add towards the total cost mark as well.

Lastly, without having a permanent base, include which rates to the record as well, while the you’ll need it to convert to a bona fide house title.