A debt settlement financing

Another replacement property equity loan for less than perfect credit consumers is a debt settlement mortgage. These loan integrates all of your expense on that fee, possibly which makes it easier to cope with your money.

If your credit history is actually lower than 640 click this over here now, you may have limited choices to combine and you may refinance your existing financial obligation. Traditional lenders typically require a good credit score score and you can collateral in order to secure fund. But not, there are lots of subprime credit loan providers that offer unsecured loans in order to consumers that have poor credit results but discover you’ll likely has to spend higher interest levels.

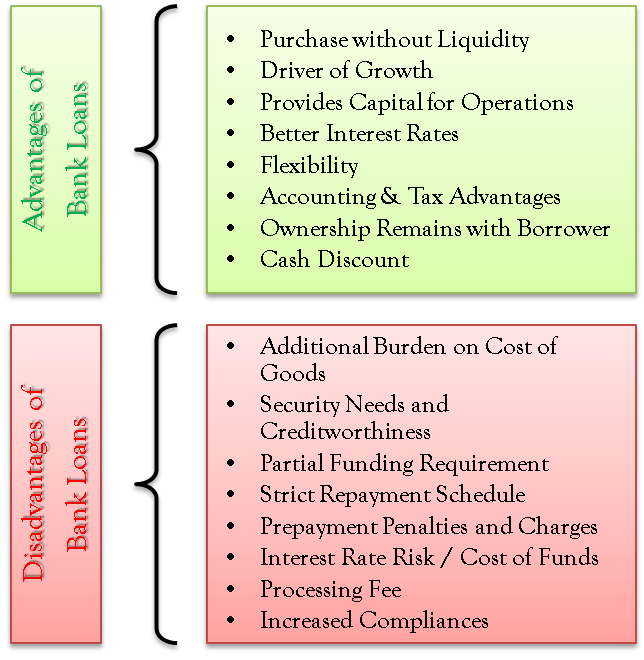

Rates of interest getting debt consolidation loans can differ dependent on the creditworthiness and lender. Centered on financial reports offer, subprime loan providers may charge rates from ten% doing 35% to combine the money you owe towards the you to definitely loan. Payment conditions will get are normally taken for one 5 years, although some loan providers can offer lengthened installment periods up to 10 if you don’t fifteen years.

Even though it may express your debt repayments, it’s also possible to become investing a great deal more for the notice along the lives of your loan. Definitely research rates, and evaluate prices and loan amount regarding some loan providers at HouseNumbers before carefully deciding.

A great 401(k) loan

A different alternative for people with bad credit who will be struggling to secure a traditional house security loan is accessing the 401(k) senior years make up the new required financing. Although not, it is essential to weigh the risks and you can experts before making a decision to locate a loan on the 401(k) because may affect your retirement deals.

You to benefit of an excellent 401(k) loan is the fact you will find normally zero credit report, disgusting monthly income criteria, or settlement costs, therefore it is an available selection for people with poor credit. At the same time, the eye prices towards the 401(k) financing is lower than those to your personal loans such unsecured loans or credit cards.

It is vital to note that 401(k) loans routinely have a maximum borrowing limit regarding both $50,000 otherwise 50% of balance, any kind of is actually quicker. It isn’t really adequate to shelter higher expenditures particularly a family recovery otherwise consolidating present personal debt.

Perhaps you to otherwise many of these household guarantee financing solutions will be right for you. Truly, easily needed to choose one of your over that isn’t home financing, I would personally make certain You will find a solid want to pay off they back the moment I could.

While looking for loan providers just who provide a house security mortgage having less than perfect credit, it’s important to shop around and you may evaluate selection off numerous lenders. Pick loan providers just who focus on borrowers which have quicker-than-prime credit and you may that will provide aggressive interest levels.

You may also be interested in handling Household Numbers, who’ll help you find an educated household guarantee loan alternatives predicated on your own personal finances and you will less than perfect credit.

In the long run, have patience and you may persistent in your identify a house security loan. It could take a little while to acquire a loan provider that is willing to aid you so you can access the amount of money you should reach finally your needs.

Find a very good means to fix unlock home equity

Disclaimer: These is provided to possess informational purposes just and should not be considered tax, deals, economic, otherwise legal advice. Every information shown the following is having illustrative purpose merely therefore the writer isnt and work out a recommendation of every form of device more yet another. The opinions and opinions indicated in this article get into the journalist.

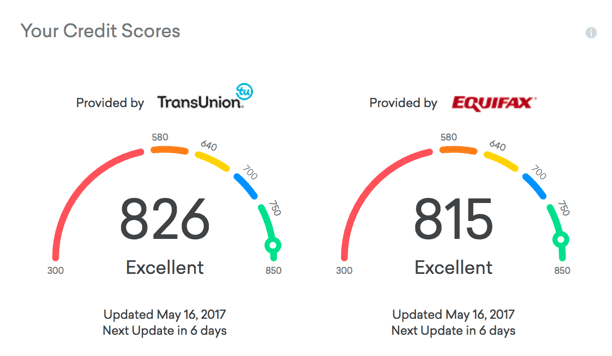

This means he’ll have to pay $40,320 most throughout the borrowed funds name (30 year financing) than just when the his borrowing is directly tracked in which he got borrowing from the bank results more than 760. I analyzed their credit report and discovered his problem are higher credit utilization.

Family Collateral Assets (HEI)

Even with these types of drawbacks, a personal bank loan can nevertheless be a viable option for people who are in need of immediate access so you’re able to cash and cannot qualify for an effective household equity financing with less than perfect credit. Just make sure to-do your search and you may evaluate rates and you may words to possess unsecured signature loans of other loan providers prior to a choice.