When you yourself have a decreased credit rating, the notion of to acquire a home will be overwhelming. not, it is very important know that you will find options available to aid you get a house, particularly less than perfect credit mortgage brokers. Towards correct advice and you will resources, will still be most likely and also make your ideal out-of getting good household possible.

With regards to securing a mortgage, it is very important just remember that , your financial fitness was advanced and you will multifaceted, and cannot getting totally caught because of the a simple around three-thumb amount. While loan providers consider carefully your credit score an important grounds, it is really not the only one.

For those who have bad credit, its natural feeling concerned with your odds of qualifying to have a home loan. not, it is essential to just remember that , never assume all poor credit is made equivalent. Including, if the lowest credit rating comes from a one-day medical disaster, loan providers get evaluate your role in another way than for those who have an effective reputation for overlooked payments otherwise defaults.

- How much available to possess a deposit

- The debt-to-money (DTI) proportion

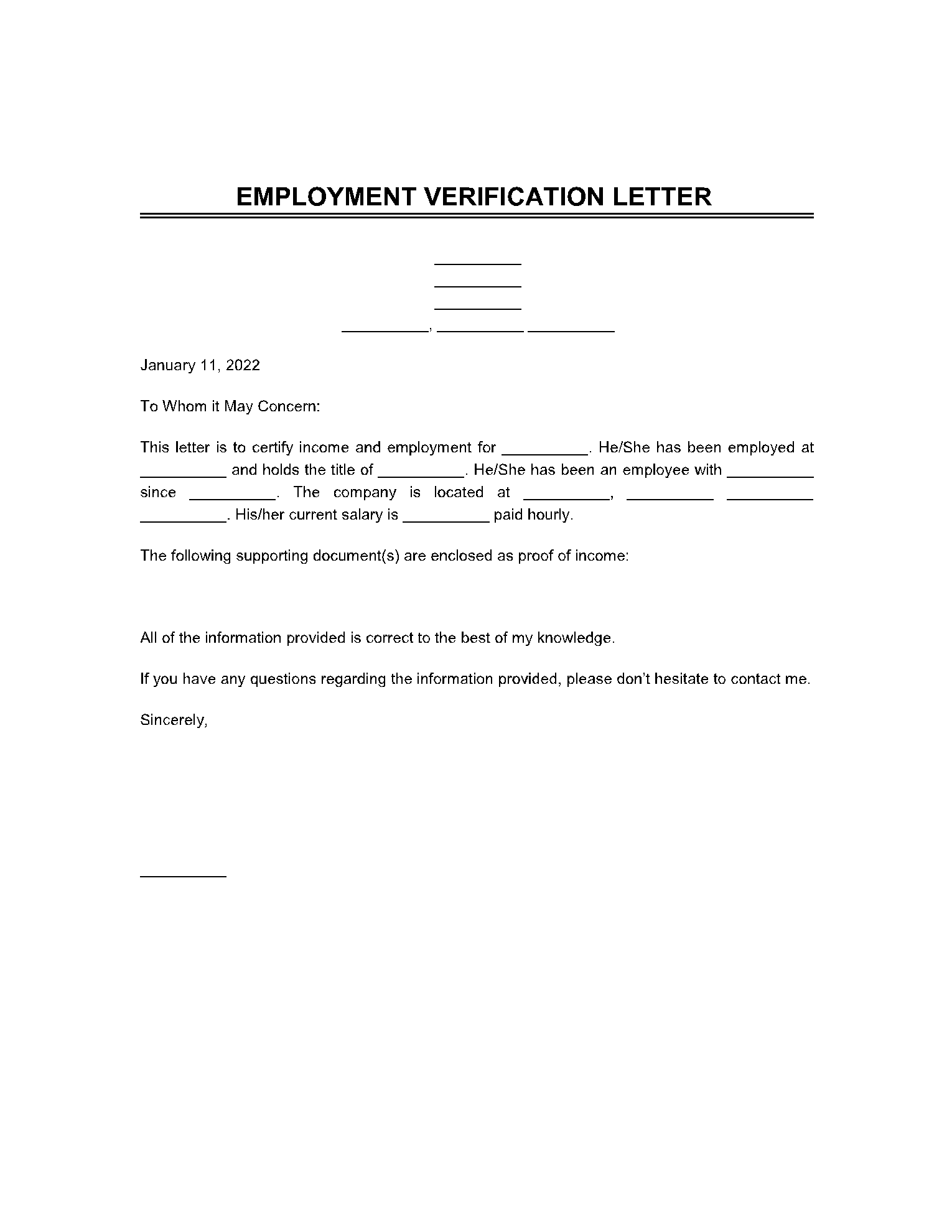

- Your a job history

- Your own commission records

Very, if you have a less-than-best credit history, you should never become frustrated as there may still become possibilities to possess protecting a mortgage.

Brand new copy plan: Repairing their score and then refinancing

If you’re considering providing a poor credit financing, it is essential to be aware that you may need to spend a higher month-to-month homeloan payment on account of high interest rates. not, understand that to order a house that have bad credit cannot indicate you may be trapped with the help of our terminology permanently. You can always take the appropriate steps to repair your borrowing throughout the years and you may re-finance your mortgage for better mortgage conditions afterwards.

What exactly is a less than perfect credit rating?

You will find three major credit bureaus – Equifax, TransUnion, and you will Experian – and you can numerous version of fico scores. But not, 90% of the market leading lenders fool around with FICO Results.

The beds base FICO credit ratings consist of 3 hundred so you can 850, with the average score on You.S. getting during the 714. We have found a glance at the categories regarding FICO Scores:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Exceptional: 800-850

When you’re an effective FICO Rating with a minimum of 670 is a, certain homebuyers is also qualify for a mortgage that have a cards get only five-hundred, with respect to the loan program.

Such four mortgage options are built to help borrowers which have low fico scores go their homeownership needs. Conditions and you may credit rating minimums will vary by the system.

FHA loan: five hundred credit history

Backed by brand new Federal Homes Government (FHA), FHA fund was an appealing financing option for basic-big date homeowners and you may reduced-credit consumers with the lenient credit history criteria. You could potentially qualify for an enthusiastic FHA loan that have a credit rating as low as 500, nevertheless the lowest down payment called for relies upon the credit get. When your credit rating was 580 or maybe more, you could qualify with step three.5% off. In case your score are ranging from five-hundred and you can 579, you happen to be expected to put 10% down.

Virtual assistant loan: 580 credit score

Supported by the latest Company away from Veterans Activities (VA), Virtual assistant loans are around for veterans and you will active-obligations provider participants. Va financing support 100% resource, but some loan providers might need a single-big date resource payment. Whilst Va will not set at least credit score needs, extremely lenders would. Financing Pronto, such as for example, features an effective 580 minimum borrowing needs.

Federal national mortgage association HomeReady: 620 credit history

Fannie Mae’s HomeReady home loan is a low deposit antique mortgage program geared toward low-money and you can low-credit consumers, and you will earliest-date or recite homebuyers. HomeReady demands only step cash advance Florida Garcon Point three% off and you may a beneficial 620 credit rating.

USDA mortgage: 640 credit history

For those looking to purchase a home in the a being qualified rural urban area, the newest You.S. Agency of Agriculture (USDA) brings a good $0 downpayment option for reasonable- to help you average-money homebuyers. Most loan providers need a great 640 credit score in order to be considered, together with other standards particular so you’re able to USDA money.

Freddie Mac Family You are able to: 660 credit score

The new Freddie Mac computer Family You’ll mortgage is yet another low down fee mortgage program designed for really low-so you can reduced-earnings borrowers, first-go out homeowners, move-right up individuals and you can retired people. House It is possible to requires an excellent 3% advance payment and you may a credit rating as little as 660 having get transactions.

Financing Pronto will be here to help with your entire mortgage demands, together with house instructions and refinancing. Located a free speed price or over our on the web loan application discover pre-acknowledged.

Simultaneously, use our very own totally free financial and you may amortization hand calculators to choose your monthly commission, also financial insurance rates, taxation, interest, and more.