Consumer Compliance Mind-set: Third One-fourth 2013

In the wake of your overall economy, household property viewpoints refused significantly in several areas. In reaction, of many financial institutions suspended home equity personal lines of credit (HELOCs) or reduced borrowing from the bank limitations, performing conformity and you will fair lending threats. While you are property costs enjoys rebounded in the lows of your crisis, creditors must remain mindful of the personal debt around Control Z when a serious lowering of an effective property’s worthy of that desired good collector to take such measures has been healed. Financial institutions must admit new fair financing risk of the such strategies. This short article provides an introduction to the newest conformity requirements and you may dangers when a creditor requires step toward a HELOC due to a improvement in property value. 1

Controls Z Compliance Requirements

Section of Regulation Z imposes high conformity requirements to the HELOC loan providers. It section not only requires disclosure off plan fine print but also essentially prohibits a collector away from altering all of them, but within the specified activities. One to scenario helping a creditor so you can suspend an excellent HELOC or beat its credit limit is when the property protecting this new HELOC enjoy a serious decline in well worth, because the considering into the 12 C.F.R. (f)(3)(vi)(A):

No creditor get, by the deal or otherwise … change people name, except that a creditor could possibly get… prohibit a lot more extensions regarding borrowing from the bank otherwise reduce the borrowing limit appropriate so you’re able to a contract while in the one period where in fact the value of the dwelling that secures the plan refuses significantly below the dwelling’s appraised really worth for purposes of the plan. dos (Emphasis extra.)

The fresh control does not identify a good extreme decline. But not, Review (f)(3)(vi)-6 of your Official Personnel Feedback (Commentary) will bring financial institutions with a safe harbor: If the difference between the initial credit limit and the offered collateral try reduced in half due to a worth of decline, the latest decline is viewed as significant loans in Summerdale, permitting financial institutions to help you refute most credit extensions otherwise slow down the credit limit to have an excellent HELOC plan.

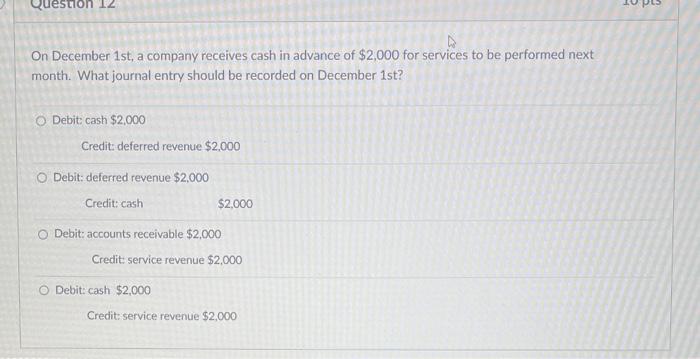

When choosing if or not a life threatening reduction in value features occurred, loan providers will be evaluate the latest dwelling’s appraised really worth at origination up against the latest appraised well worth. This new table less than will bring an illustration. step 3

In this analogy, the newest creditor could exclude subsequent enhances or slow down the borrowing limit in the event your worth of the house or property declines of $100,000 to $ninety,000. Administration might be conscious that even though they may be permitted to reduce the borrowing limit, the reduction cannot be underneath the number of this new the balance when the performing this would need an individual and then make a top fee. cuatro

Worth of Measures

The brand new creditor is not needed to find an appraisal in advance of reducing otherwise freezing an excellent HELOC in the event the domestic worthy of features dropped. 5 not, to own examination and you will recordkeeping intentions, the new collector is maintain the paperwork where it depended in order to establish one to a critical reduction in worth of took place prior to taking action on HELOC.

Inside , new Interagency Credit Chance Administration Suggestions to possess Home Equity Credit are composed, which has a dialogue out-of collateral valuation government. 6 The brand new guidance provides types of exposure management techniques to take on when using automated valuation activities (AVMs) otherwise income tax review valuations (TAVs). Subsequent guidance on suitable practices for making use of AVMs or TAVs are offered regarding Interagency Assessment and Evaluation Assistance. seven Management may prefer to take into account the pointers while using the AVMs or TAVs to choose whether a serious decline has actually taken place.

In addition to regulatory conformity, associations should be aware of you to definitely lots of group step suits was in fact submitted challenging the utilization of AVMs to reduce credit limits or suspend HELOCs. 8 The fresh new plaintiffs in these instances has confronted various aspects of conformity, such as the accessibility geographic place, as opposed to individual property valuation, as a factor to have an excellent lender’s looking for off loss of well worth; the brand new AVM’s precision; and the reasonableness of your appeals procedure set up where a debtor can get challenge brand new decrease in the newest personal line of credit. Inside light on the legal actions chance, it is essential getting organizations to spend attention so you can conformity requirements.