So the inventory left at the end of the period is the most recently purchased or produced. In a periodic system, companies calculate Cost of Goods Sold (COGS) directly after a physical inventory, as they do not keep it on a rolling basis, nor do they update it continuously after each transaction. They do not keep an inventory account in a periodic system since they debit all purchases to a purchase account. Once the period is complete, the company adds the purchase account totals to the inventory’s beginning balance. Then, the company can also compute the cost of goods available for sale for the new period.

A Contractor’s Fall Accounting Checklist: A Guide to a Smooth Year-End Close

This is why LIFO creates higher costs and lowers net income in times of inflation. On December 31, 2016, a physical count of inventory was made and 120 units of material were found in the store room. A trading company has provided the following data about purchases and sales of a commodity made during the year 2016. It is the amount by which a company’s taxable income has been deferred by using the LIFO method. Let’s say you’ve sold 15 items, and you have 10 new items in stock and 10 older items.

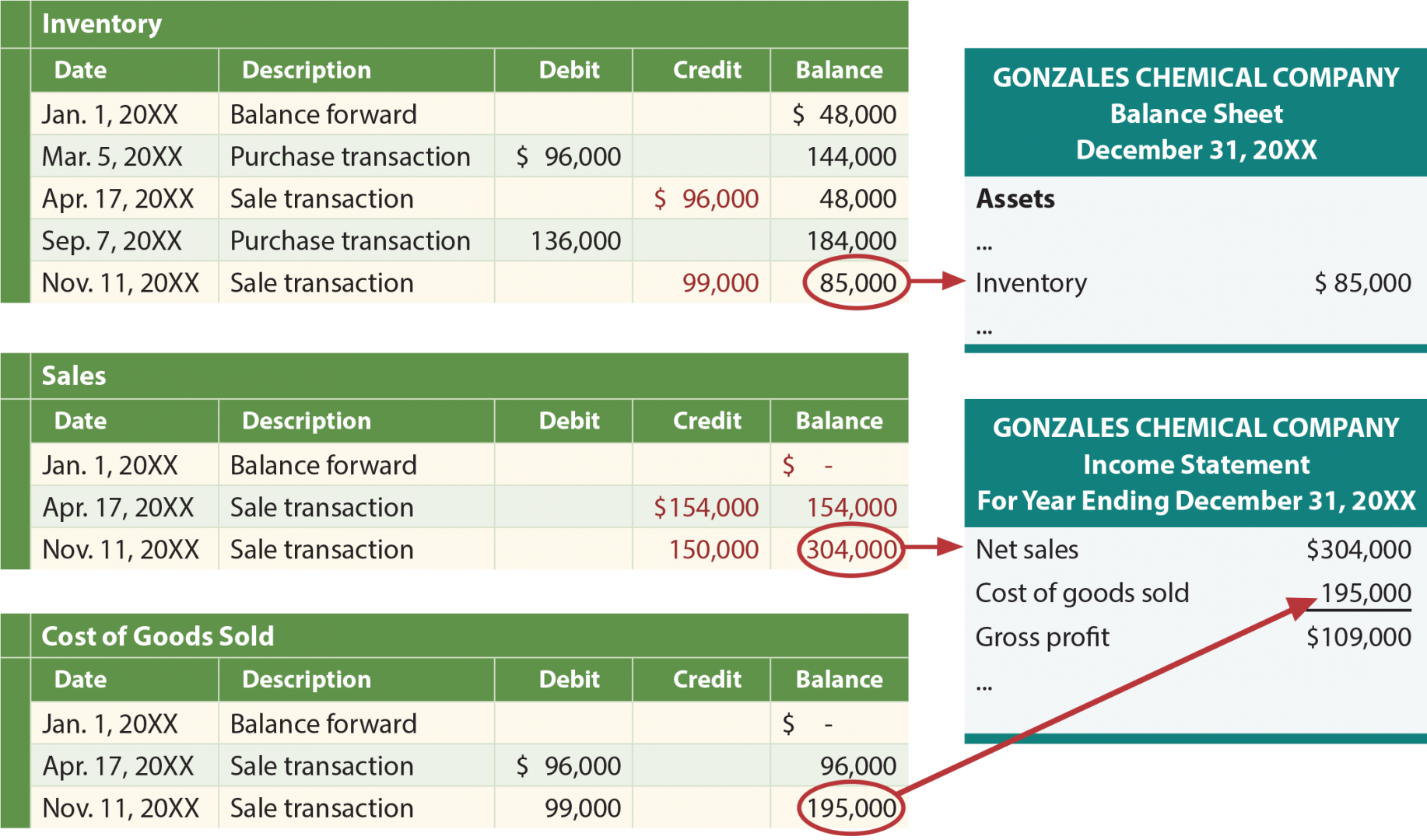

Description of Journal Entries for Inventory Sales, Perpetual, Specific Identification

In a period of falling prices, the value of ending inventory under LIFO method will be lower than the current prices. LIFO method values the ending inventory on the cost of the earliest purchases. The example above shows how inventory value is calculated under a perpetual inventory system using the LIFO method.

- Products are barcoded, and point-of-sale (POS) technology tracks these products from shelf to sale.

- Perpetual inventory is computerized, using point-of-sale and enterprise asset management systems, while periodic inventory involves a physical count at various periods of time.

- The $87.50 (the average cost at the time of the sale) is credited to Inventory and is debited to Cost of Goods Sold.

- According to the perpetual timeline, the only sale made during the month is from the opening inventory which means that the ending inventory is entirely based on the 3 units purchased during the month.

How to use LIFO for costs of goods sold calculation

The particularity of the LIFO method is that it takes into account the price of the last acquired items whenever you sell stock. Perpetual inventory systems are helpful for those who always need to understand margins and profitability. A large business with many products or a company that wants the ability to scale an emerging business over time would use a perpetual inventory system. In recent years, advances in inventory management software and the ability to integrate it with other business systems have made perpetual inventory a more practical and powerful option for many businesses. Additionally, cloud-based inventory management systems are often real-time, a key element of a perpetual inventory system. Your cost of ending inventory and COGS for the period comes from the schedule with no further adjustments.

Comparing Perpetual LIFO and Periodic LIFO

Such a situation will reduce the profits on which the company pays taxes. Notice how the cost of goods sold could increase if the last prices of the items the company bought also increase. What happens during inflationary times, and by rising COGS, it would reduce not only the operating profits but also the tax payment.

Business

If Kelly’s Flower Shop uses LIFO, it will calculate COGS based on the price of the items it purchased in March. The value of ending inventory is the same under LIFO whether you calculate on periodic system or the perpetual system. Let’s calculate the value of ending inventory using the data from the first example using the periodic LIFO technique. Out of the 18 units available at the end of the previous day (January 5), the most recent inventory batch is the five units for $700 each. In contrast, using the FIFO method, the $100 widgets are sold first, followed by the $200 widgets. So, the cost of the widgets sold will be recorded as $900, or five at $100 and two at $200.

Lastly, we need to record the closing balance of inventory in the last column of the inventory schedule. Based on the calculation above, Lynda’s ending inventory works out to be $2,300 at the end of the six days. Last In First Out (LIFO) is the assumption that the most recent inventory received by a business is issued first to its customers. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Weighted average costing offers simplistic inventory cost management and is commonly used by many new manufacturers. FIFO offers a company financial reporting that reflects their industry’s current market conditions and is often the choice of a manufacturer dealing with perishable goods. LIFO offers an approach for any manufacturer operating in an inflationary environment looking to minimize their tax liability. Finally, standard costing will provide a focus on cost control and overall planning for any organization, and usage is heavily concentrated on large manufacturing organizations. All four of the listed methodologies offer distinct benefits, making it important for management to assess which option aligns best with the strategic direction of their company.

This schedule will serve as your guide to what layer needs to be updated. Figure 10.20 shows the gross margin, resulting from the weighted-average perpetual cost allocations of $7,253. what is the difference between depreciation and amortization Let’s return to The Spy Who Loves You Corporation data to demonstrate the four cost allocation methods, assuming inventory is updated on an ongoing basis in a perpetual system.